For the 2023–2024 financial year, agencies holding official overseas employment service licences must settle taxes based on the number of workers deployed abroad by country. These agencies must report and settle their taxes at the relevant township revenue offices no later than August 2024.

On 7 June 2024, revenue offices informed agencies that they must settle their outstanding taxes. Again, on 9 May 2025, agencies that had not yet paid were notified to settle their taxes by the final deadline of 31 May 2025.

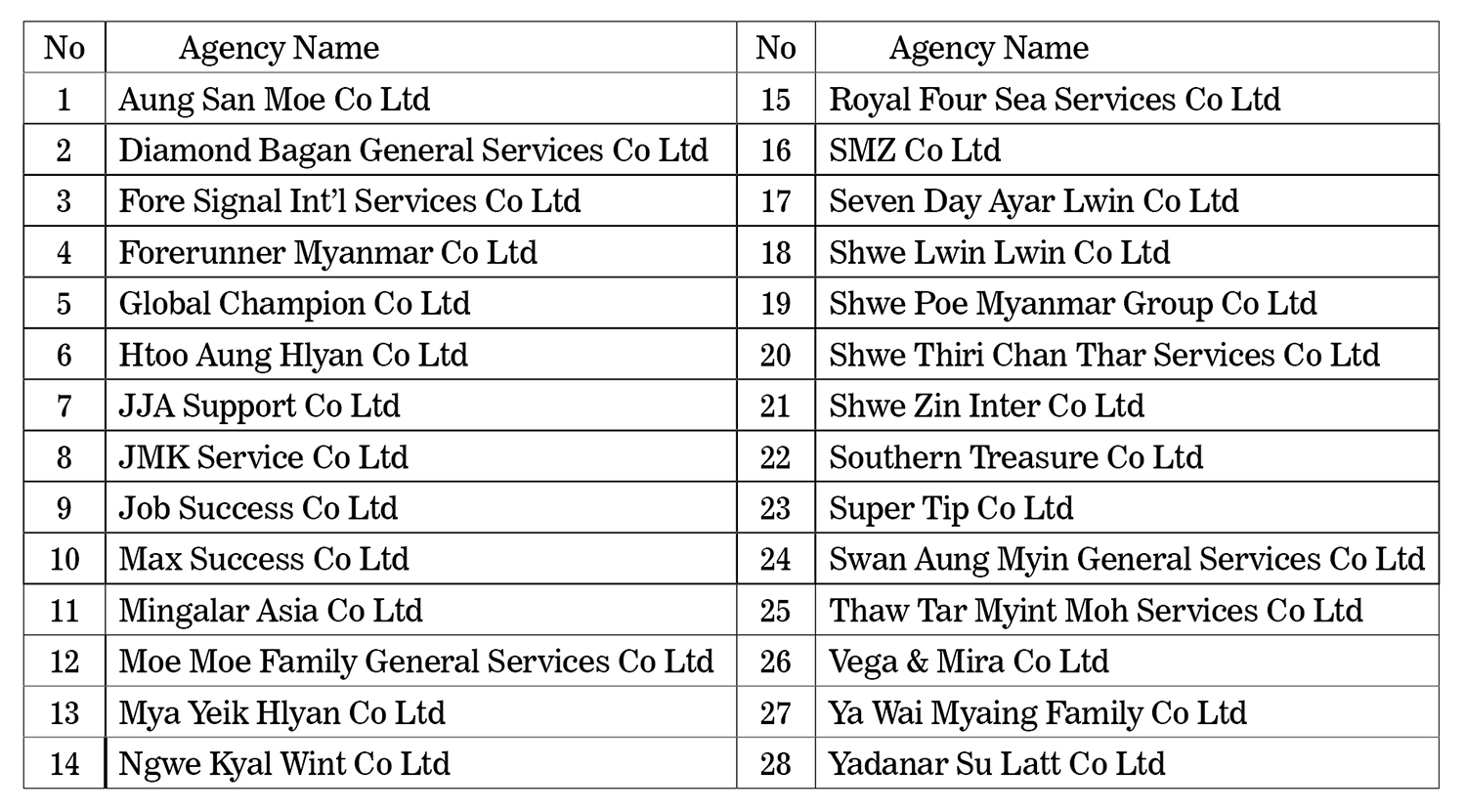

The revenue department has notified the following 28 agencies, which have not yet fulfilled their tax obligations, to settle their dues at the township revenue offices before 31 May 2025. Failure to do so will result in the revocation of their overseas employment service licences and inclusion in the blacklist.

#TheGlobalNewLightOfMyanmar